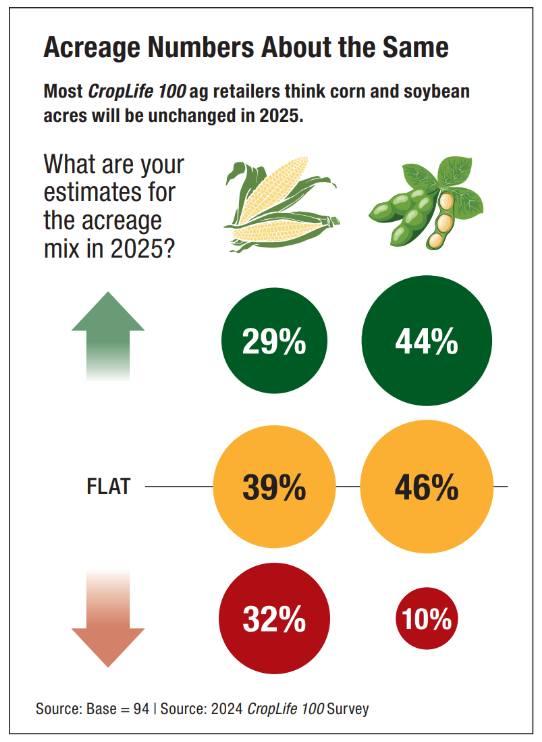

Amid shifting agricultural horizons, investments in soybean infrastructure and promotion strategies are exerting a striking influence on both domestic output and market vibrancy. As the 2025 planting season unfolds, American farmers have signaled intentions to sow approximately 83.5 million acres of soybeans— a 4% contraction compared to last year’s expansionist ambitions. At first glance, one might interpret this swift decline in acreage as a cautionary note for U.S. producers; however, developments beneath the surface tell a different story.

An intriguing subplot accompanies this reduction: while sown area is narrowing, yield per acre is forecasted at 52.5 bushels—greater than last year’s metric of 50.7 bushels per acre. In other words, fewer fields could potentially yield more beans individually than before, highlighting advances in agronomic practices or perhaps serendipity with seasonal conditions.

But beyond yield math lies an evolution in processing capacity that sends ripples across sector economics—a true commodity trader’s delight if you factor its implications further downstream. Since 2023, nine new or revamped soybean crush facilities have joined the domestic industrial landscape; seven more will soon follow suit or are under steelwork assembly at least on paper. The expansion isn’t confined solely to volume capability—it signals intensified demand for beans destined not just for export bins but also oil extraction belts and protein meal shipments.

It warrants mentioning that projected ending stocks exhibit unusual tightness: USDA pegs leftover U.S. soybeans after next harvest at just 295 million bushels—a sharp descent of about 16% from what was available after the previous campaign. If one analyzes such numbers closely (which traders certainly do), lower carryover often amplifies price sensitivity to even minor external shocks—like international trade fuss or South American weather outbursts.

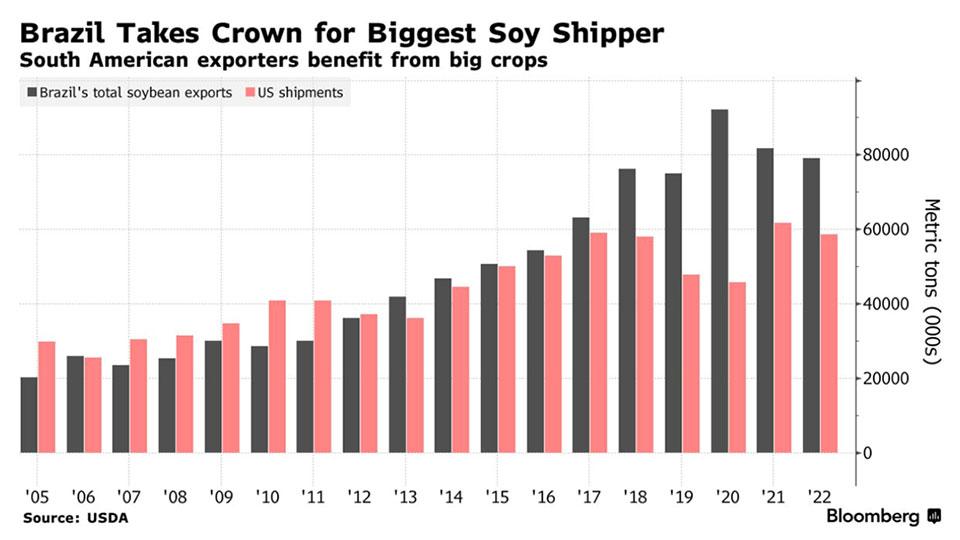

Speaking of Brazil: their energized push into soybean fields produces vivid contrasts worth highlighting alongside North American developments. Brazilian production appears headed for another personal best: estimates touch an astonishing range near 175 million metric tons come next harvest—up roughly three-and-a-half percent above their prior ceiling moment set only last season. This relentless advance introduces fresh competitive tension globally but simultaneously underscores why U.S.-based investment remains focused not merely on growing more beans but refining how those beans bring value back home.

What guides these corporate maneuvers? Partly it is derived from bullish undertones embedded within global consumption projections—the world expects usage rates to climb by about 3.4%, driving total stocks-to-use ratios upward yet still maintaining some tight quarters compared against appetite trajectories over past cycles. When commodity strategists review such ratios—which clocked in around twenty-nine percent—they point out this figure stands slightly taller than ten-year averages yet interestingly dips below where matters stood only one marketing cycle ago.

Producers and investors must navigate fractured terrain when it comes to promotion efforts as well as field investments; context shapes narrative here rather unpredictably (though some would argue otherwise). Some advocacy collectives channel fresh resources into education-focused campaigns targeting both domestic buyers and international procurement leaders who weigh sustainability credentials with increasing vigor. Others concentrate efforts elsewhere—for instance orienting toward expanding high-oleic varieties that fetch premiums thanks mostly due health-oriented food industry clients seeking alternative lipid profiles.

While logic sometimes leans toward amplifying exports as the central promotional goal during times of supply growth—or so conventional agronomics courses teach—the present reality has strategic nuance at its core instead: USDA anticipates reductions in overseas shipments (dropping by thirty-five million bushels) offsetting surges within domestic crushing lines slated to absorb seventy million additional bushels themselves relative to last cycle numbers .

Not all moves by investors mirror textbook optimality either; capital recently poured into seemingly redundant infrastructure projects led sector observers puzzled before subsequently clarifying through subtle alignment with vertical integration schemes rarely found outside specialty crops until now. Alignment between seed technology labs and biofuel refineries means value chains rewire themselves organically—even if unintended overlaps occasionally spark debate over resource allocation wisdoms left unchallenged during capital rushes decades past.

A crucial aspect often missed involves farmer-level economics rather than just macro trends swirling overhead like May thunderclouds without warning signs at dawn—the expected average farmgate price floating around $10.25 per bushel inspires optimism since it edges higher than the preceding period despite cyclical pressures bearing down elsewhere amidst comparable commodities pricing slumps .

To study these developments adequately is to realize sector fortune pivots not solely upon bean counts—but upon adaptive responses flowering wherever policy adjustments sprout opportunity rooted equally within risk calibration exercises customarily reserved only for financial professionals during heavier volatility periods previously barking far louder than current market temperament suggests they should be.

Across landscapes ringing with engine clatter—from Illinois’ river elevators outward through inland terminals pulsing anew amid pandemic recovery lags—one discerns momentum built less from algorithmic precision and more from organic adaptation interlaced throughout production decisions shaped daily by unforeseen wind shifts both atmospheric and economic alike—a pattern likely persisting while new investments steer both machinery gears and promotional energies faster forward despite narrower land commitments presently charted upon spreadsheets awaiting springtime confirmation once again.