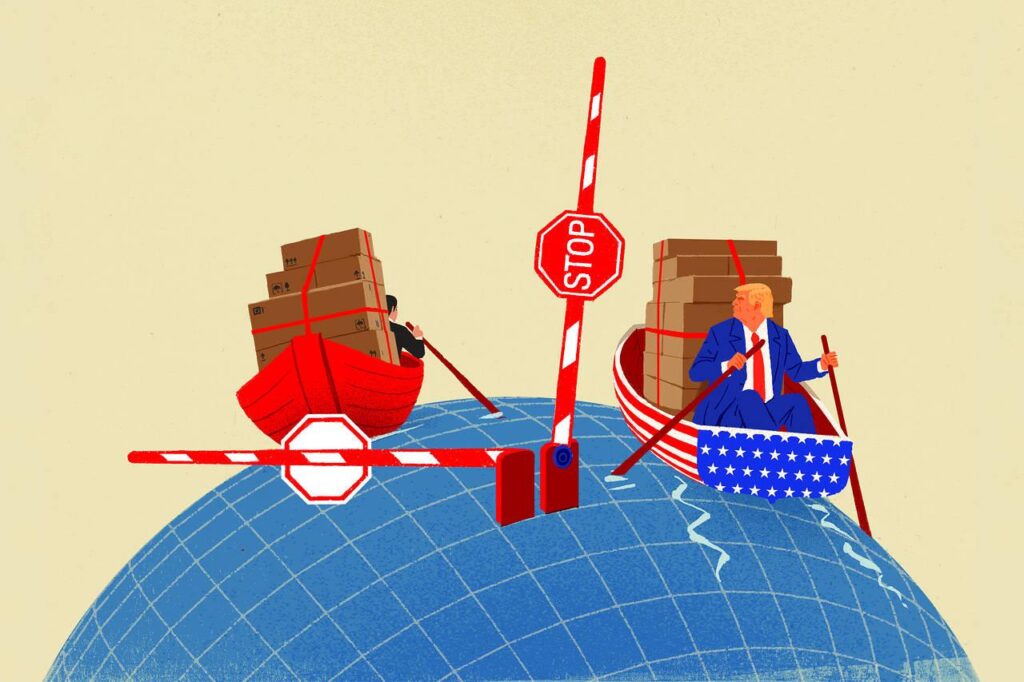

American agriculture, famously resilient and at times romanticized as the backbone of the nation’s economy, has again found itself battered by externalities beyond its control. Tariffs wielded as instruments of presidential policy have proven to be a double-edged sabre; while intended to strengthen domestic interests, they have—again—induced turmoil with acute severity across farm country.

Soybeans once flowed steadily from midwestern silos into Chinese ports; now those pathways twist elsewhere. After Donald Trump imposed a sweeping array of tariffs during his first term, China retaliated—seeking alternative suppliers such as Brazil—and U.S. farmers endured an abrupt $27 billion plunge in agricultural exports between 2018 and 2019. This cataclysm forced many multigenerational family farms toward financial precarity that would have been unthinkable only years before—not even commodity price hedging proved much buffer against geopolitics’ unpredictable furnace.

To soften this economic detonation,the management deployed an emergency $28 billion bailout: a sum nearly matching USDA’s total annual discretionary budget for some federal agriculture programs but now dwarfed by current tariff ambitions. In their fresh iteration this year, new tariffs are broader and steeper then ever before; their aftershocks appear poised to reverberate more widely than previous trade convulsions.

zippy Duvall from the American Farm Bureau Federation warns unequivocally that escalated tariffs inflate critical input costs while overseas demand contracts further—a one-two punch undermining competitiveness right down to the soil line for U.S. staples like corn, soybeans, pork, and apples.

“Tariffs will drive up the cost of critical supplies,” he cautioned not long ago (and nobody shrugged off his words). For decades exports composed over one-fifth of average farm income; suddenly losing even half that volume slices deep into rural liquidity. The risk isn’t just cyclical—it’s existential: buyers courted away by rival states may never return if they strike more stable deals there in future marketing seasons.

The current policy wave didn’t arise overnight nor dose it exist isolated from other structural controversies roiling modern agriculture—like production quotas or concentrated agribusiness power—but this particular experiment magnifies volatility at every level within U.S. commodity chains. Rapidly increasing input costs inevitably precipitate additional symbolic grievances: missing equipment upgrades here or delayed loan payments there thread together incremental hardships until outright closures become unachievable to ignore for rural economies.

Statistical quirks compound these narratives: While soybean prices oscillated wildly (summer contracts in some regions dropped up to 20% post-2018), livestock producers also saw margins pinched both thru feed inflation and shrunken export quotas for meat products heading abroad—the sort of ricochet effects frequently enough overlooked in distant Washington offices where trade targets are set by officials mostly insulated from day-to-day weathered realities.

Simultaneously public finance consequences swirl with unpredictable momentum about all this fiscal interventionism: massive bailouts require congressional appropriations cycles already stretched thin amid ballooning national deficits—a situation likely exacerbated rather than relieved as additional compensation requests mount alongside future tariff expansions still pending review.

Consider an unusual yet illustrative comparison: If policymakers invested equivalently robust sums ($28 billion) annually into regenerative soil conservation strategies instead—or targeted support directly towards crop diversification incentives—the longer-term resilience resulting might actually exceed any benefit produced through short-term ad hoc bailouts following market collapse events provoked largely by governmental action in the first place (although few advocates within dominant lobbying circles openly discuss such alternatives).

Still another unintended corollary emerges across grocery spending habits nationwide—tariff-induced bottlenecks produce higher shelf prices not only on imported goods but ironically (and rarely acknowledged), even domestically harvested vegetables sometimes escalate in cost owing both to disrupted supply networks plus localized labor dislocations when farmers cut acreage or idle machinery due uncertainty over market access next quarter or year. Then again grocery bills were lower during certain months last year despite ongoing turmoil—that said many consumers still reported sticker shock when tomato prices rose unexpectedly fast earlier this spring—to illustrate how demand elasticity rarely synchronizes perfectly with global export patterns set awry by politics.

Perhaps most troubling however is how these macroeconomic ripples intertwine with persistent sectoral inequities already embedded deep within contemporary agricultural paradigms—from crop insurance instruments favoring large acreages operated under economies-of-scale assumptions onto environmental degradation incurred through monocultural systems intensified solely for maximized exports previously subsidized via precisely those international agreements recent policies derogate so vigorously against—in effect making outcomes profoundly less predictable except that smallholder operations continue carrying outsized risk burdens compared vis-à-vis corporate giants adept at weathering stormier profit projections.

Ultimately then if past is prologue—with inherent unpredictability faced annually due droughts or blights compounded now aggressively via government-enforced volatility—it remains unlikely any mere checklist approach could resolve disparities accelerating anew under expanded trade confrontations whose true costs elude simple tabulation either on spreadsheets or ballot tallies elsewhere soon enough either way america seems bound inexorably toward another reckoning out where crops meet commerce headlong every single season invariably thereafter again possibly next harvest cycle already approaching faster than expected last winter when forecasts discounted further tariff escalations perhaps prematurely so anyway you look at it uncertainty looms large among furrows once planted confidently but now shadowed perpetually by shifting global currents whose directionality remains obscure still today—even optimists must concede as much reluctantly if daily accounts hold reliable witness thus far overall.