The soybean sector in China demonstrates remarkable resilience amid deteriorating trade relations with the United States. Recent data from April 2025 reveals a jarring shift in import patterns as China abruptly canceled all U.S. soybean shipments, triggering a swift decline in American agricultural exports. Despite this diplomatic turbulence, China’s overall soybean market displays signs of stability through diversified supply channels and steady domestic production initiatives.

China’s relationship with soybeans embodies a fascinating paradox. The country grows approximately 19.8 million metric tons (MMT) of soybeans annually, yet consumes a staggering 128.9 MMT, creating an unavoidable dependency on foreign imports. This consumption-production gap necessitates substantial imports, projected at 106 MMT for the 2025-26 marketing year – a modest 2% increase from the previous period.

The Chinese government continually intervenes to fortify domestic soybean self-sufficiency. Officials have implemented several strategic maneuvers across the supply spectrum. They delayed import schedules during local harvest periods, encouraged crushers to utilize higher-priced domestic soybeans, and purchased surplus domestic production for storage. These interventions highlight Beijing’s persistent concern about agricultural independence, which sometimes contradicts market efficiency principles.

American farmers face devastating consequences from China’s recent import cancellations. A cargo ship carrying U.S. soybeans was rerouted mid-Pacific in April 2025 when China spontaneously canceled all shipments. Unsold domestic soybean inventories surged 13% to reach their highest April levels since 2019. The economic aftermath was intense – spot prices at the Chicago Board of Trade fell 8.2% within days, erasing over $470 million in commodity value in just one week.

Farmer sentiment throughout America’s agricultural heartland collapsed rapidly. Matt Dunn, who farms in Des Moines, expressed his frustration to the Wall Street Journal, stating, “This is no longer a trade dispute, it’s economic isolation”. The American Soybean Association estimated that China’s withdrawal from the market could reduce farm incomes up to 18% in a single quarter.

Intriguing developments emerge in China’s domestic market adaptations. A slowing rate of growth in soybean demand is anticipated as Chinese consumers pivot from pork consumption toward more feed-efficient protein alternatives such as poultry and aquatic products. This dietary transformation may eventually alter the fundamental demand structure for soybeans within China’s complex feed industry.

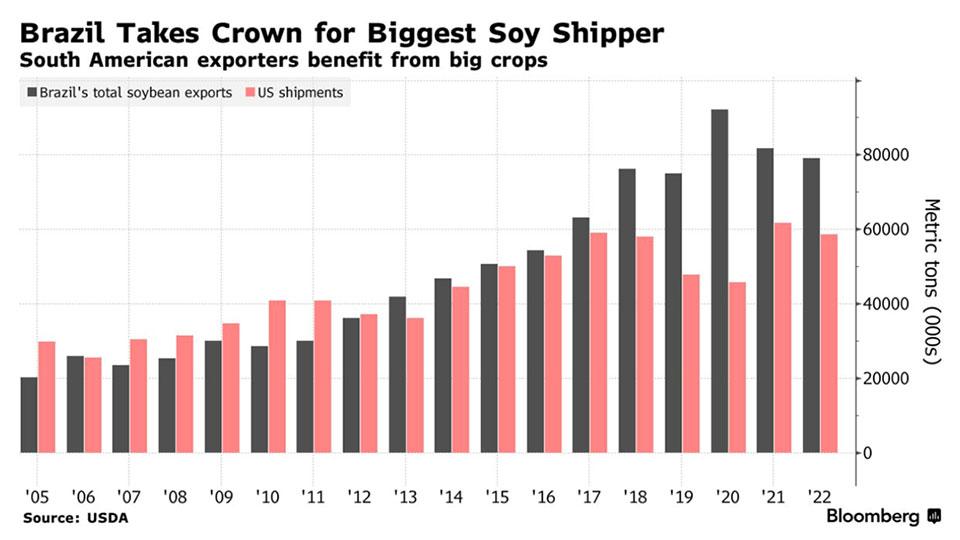

China hasn’t abandoned soybeans altogether; they’ve merely redirected procurement channels. South American producers, particularly Brazil, have emerged as principal beneficiaries of this trade reconfiguration. Brazil grows approximately 169 MMT of soybeans annually, positioning it as China’s preferred alternative supplier. Chinese traders have actively secured positions for February to April shipments, demonstrating continued robust procurement strategies despite geopolitical complications.

The global soybean market illustrates the intricate dance between politics and agricultural commerce. Trade tensions accelerated following the Trump administration’s 20% tariff on Chinese electronics, metals, and EV components announced on March 10th. China’s retribution focused precisely on America’s agricultural vulnerability – a sphere where China retained significant leverage through its massive purchasing power.

Chinese market dynamics reveal nuanced preference patterns that transcend mere price considerations. For nearby shipments, Chinese buyers gravitate toward late January shipments of Brazilian soybeans, steering clear from cheaper U.S. alternatives despite already compressed margins. This behavior suggests that factors beyond immediate economic calculations influence purchasing decisions.

Domestic processing capacity for imported soybeans exhibits curious variations. According to customs data, China’s soybean meal import volume reached 5,895.02 tons in March 2025, marking a dramatic 177.6% month-on-month increase. This surge illustrates the complex processing network adjustments occurring within China’s internal supply chain.

In upcoming seasons, U.S. soybean production faces challenging scenarios. The March 31 Prospective Planting Report indicated U.S. soybean acreage for the 2025-26 crop year would total approximately 83.5 million acres, down from 87.1 million acres the previous year. Weather patterns during summer months will profoundly impact yield outcomes and ending stock projections, adding another layer of complexity to an already volatile situation.

The transformed landscape of global soybean trade reveals how rapidly agricultural dependencies can evolve when geopolitical considerations override conventional commercial relationships. Though disrupted, China’s soybean market maintains its equilibrium through strategic adaptations, ensuring continued functioning despite dramatic shifts in traditional supply patterns.