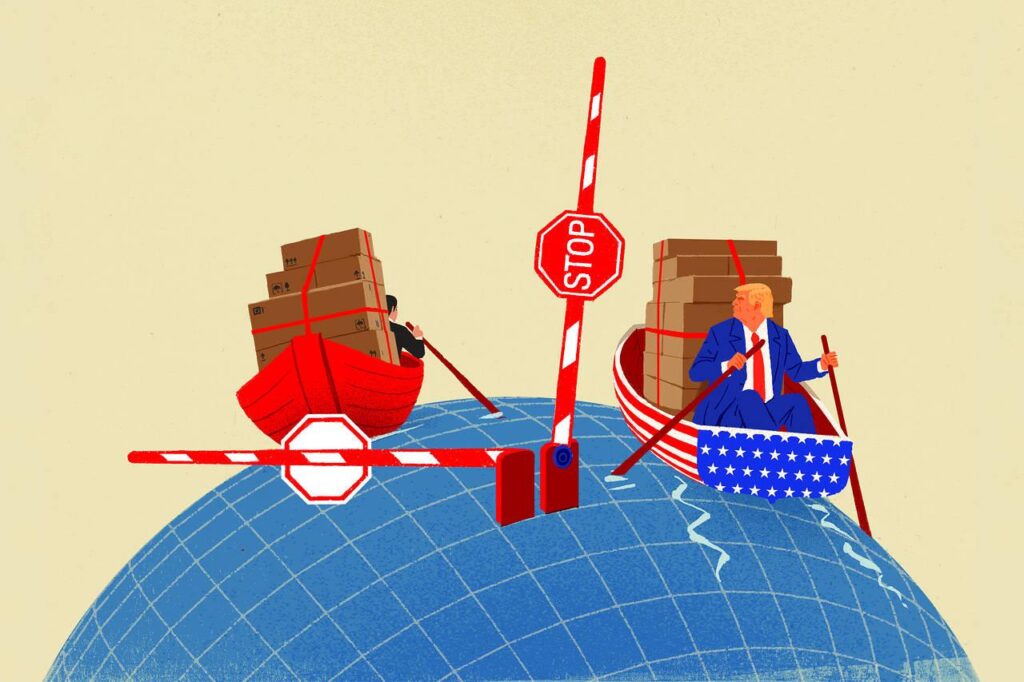

U.S. and Chinese officials, after an intense dialogue in Geneva, established a compact to temporarily reduce tariffs for a duration of ninety days. This accord marks an interlude—a fleeting pause in commercial hostilities that have typified recent U.S.-China economic interactions. Notably, the United States committed to scaling back tariffs on imports from China from a formidable 145% down to a more moderate 30%, while China simultaneously dialed its retaliatory duties down from 125% to just 10%. These figures reflect both strategic recalibration and the recognition that trade friction delivers unpredictable reverberations through global commodity corridors.

The precise mechanics are somewhat intricate. Both parties agreed not only to suspend certain additional ad valorem duties but also reaffirmed their intention to excise those surcharges imposed during the latest escalatory phase of their tariff dispute. Within China’s framework, this necessitated administrative shifts outlined by its Customs Tariff Commission—specifically suspending increments specified in various April directives. For Washington, the recalibration revolves around executive orders issued through early spring.

During these three months—which may feel short or interminable depending on vantage—delegations led by Vice Premier He Lifeng (China) and representatives like Scott Bessent (Secretary of Treasury) and Jamieson Greer (USTR) will maintain ongoing consultations across venues that might be as varied as Beijing, Washington DC, or even neutral European cities.

Parsing sectoral implications generates both hopefulness and uncertainty. In particular, American exporters view this truce through practical lenses: Dan Halstrom of the U.S. Meat Export Federation noted appreciation for renewed negotiation efforts—and anticipation that access for pork and beef products could improve if détente persists beyond ninety days. Yet nothing is certain; unexpected renegotiation may reinstate restrictions without much warning.

Sometimes policy posturing gives way to quieter technical language—terms like “reciprocal tariff rate” become relevant because they denote mirrored duty structures meant either as leverage or signaling devices during negotiation cycles. Such legalistic phrasing can seem remote; however, implications run deep for supply-chain planners accustomed—or perhaps numb—to oscillating trade costs.

With CoBank’s analysis highlighting echoes of previous commitments—the reference point being Phase One negotiations brokered under earlier administrations—it becomes evident how cyclical these confrontations are: each new truce leans on partially fulfilled purchase targets set many quarters ago (“$80 billion worth of agricultural goods,” accompanied by familiar discussions about non-tariff barriers impeding American competitiveness). Whether those benchmarks retain any predictive value is dubious at best since political winds shift swiftly.

Curiously enough, some observers expect normalcy’s return if talks succeed—that hazardous assumption ignores how prior pledges often decayed before implementation reached maturity. Then again: global traders have short memories when buying opportunities resurface unexpectedly.

To economists parsing algorithmic signals within foreign-exchange fluctuations: this episode confounds simple forecast models because market actors rapidly discount official statements but react viscerally when logistics indices wobble due to fresh customs checks or sudden documentation requirements not previously flagged at press conferences noting “necessary administrative measures” in passing detail.e

And there’s another side seldom acknowledged outright—the effect on smaller producers within both economies who lack diversified distribution networks capable of riding out swift regulatory adjustment periods. Advance notice—a crucial aspect missing during prior disputes—does little good unless government agencies coordinate with freight brokers possessing enough capacity buffering against sudden clearance surges prompted by headline-driven policy reversals.

There remains curiosity regarding contingency planning among multinational firms whose procurement divisions built up significant reserves preceding anticipated further escalation; now faced with reduced rates for three months only—they must decide whether unwinding inventory hedges carries unacceptable risk should talks falter unexpectedly. Some analysts initially assumed agreements such as this would durably reset cross-Pacific business conventions—but then hesitated once newly published stipulations revealed embedded review mechanisms making it conditional upon future progress rather than automatic continuity after ninety days.

At odd moments during recent briefings there emerged phrases hinting at enduring complexity—for instance references here or there (perhaps intentionally ambiguous) about suspending certain “non-tariff countermeasures,” although specifics differed between press releases depending upon which ministry drafted them first.

Perhaps what makes this episode most atypical is not its magnitude but rather its timing—with several major economies preparing midyear budget adjustments while awaiting further signals about whether de-escalation sticks beyond August. It would be hasty declaring watershed change until recurring practical difficulties are resolved—or reappear—with little advance warning except perhaps an offhand remark inside some working-level consultation summary not yet released publicly.

After all is considered daily trading resumes; warehouses hum anew under different conditions–at least until someone calls again for newer tariffs pretending old disagreements never happened at all.