Global agricultural markets face swift transformations heading into the 2025/26 marketing year. Major crops show varying trajectories. The latest USDA projections reveal complex patterns that warrant attention from industry stakeholders and market observers alike.

Corn Outlook: Breaking Records

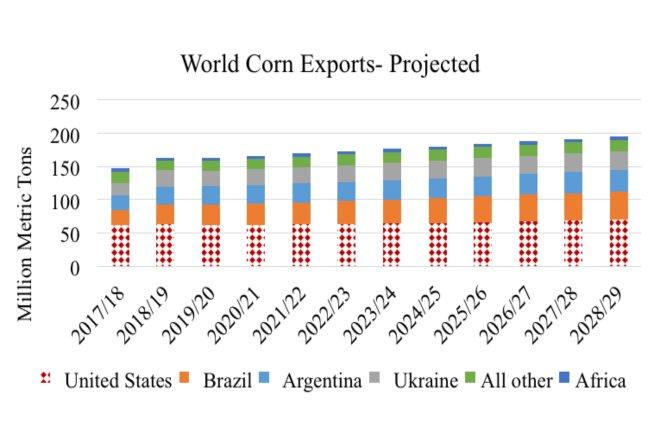

American corn prospects shine brightly for 2025/26. USDA forecasts point to record supplies coupled with unprecedented use. Exports are expected to climb nearly 3% from the previous year, reaching 2.675 billion bushels – the strongest performance since 2020-21. This uptick emerges despite fierce competition from South American producers.

Brazil continues its agricultural ascension with corn output predicted to jump 18% to 29.2 million tons. The country’s export capacity has grown to 45 million tons annually, cementing its position as a formidable player in global grain markets. Brazilian infrastructure improvements have fueled this expansion in ways many traditional models failed to anticipate.

Global distribution channels remain congested. Weather patterns across major growing regions have behaved unexpectedly favorable, contributing to the abundance where scarcity might have otherwise materialized. Buyers now navigate a landscape rich with options but challenging in logistics.

Wheat Dynamics: Shifting Powers

The wheat trade presents a fascinating study in regional power shifts. Global wheat trade for 2025/26 is projected at 213.0 million tons, showing a modest recovery of 6.9 million tons from the previous year, yet remaining well under the 2023/24 high-water mark of 222.2 million.

Russia maintains its crown as leading wheat exporter with projections of 45.0 million tons, up slightly from 43.5 million in 2024/25. The European Union demonstrates the most striking comeback among major exporters, with analysts forecasting a 7.5 million ton increase to reach 34.0 million tons. This turnaround follows several challenging seasons for European producers.

India and the EU display the largest increases for food, seed, and industrial use and feed and residual use, correspondingly. This consumption growth underpins demand resilience even as production capacities expand worldwide.

Global ending stocks are expected to settle around 265.7 million tons, a minuscule 0.5 million ton increase from the previous year. China and Pakistan show the most significant reductions, while India, the United States, and the EU contribute the largest stockpile expansions.

Soybean Market: Abundant Yet Tight

The soybean picture presents a puzzle of seemingly contradictory indicators. Global supplies continue their expansion driven primarily by Brazilian production, yet U.S. stocks face tightening constraints.

USDA pegged the 2025 U.S. soybean harvest at 4.34 billion bushels, representing a small decline of 26 million bushels from the previous year. Despite this reduction, yields are improving to 52.5 bushels per acre from 50.7 bushels in 2024. American ending stocks for 2025-26 are forecast at 295 million bushels, a 16% drop that surprised analysts who expected around 375 million bushels.

Domestic crushing demands within the U.S. may leap by 70 million bushels to 2.49 billion, which partially explains for the tightening stock situation despite strong production.

Brazil marches toward another record soybean crop, projected at 175 million metric tons for 2025-26, representing a 3.6% increase from the current year’s 169 million tons. The country’s export dominance grows unchallenged, claiming approximately 60% of global market share.

Global soybean exports for 2025/26 are anticipated to increase 4 percent to 188.4 million tons from 2024/25, with major South American producers leading this expansion. U.S. soybean exports, however, may decrease by 35 million bushels to 1.815 billion bushels despite the overall global growth trend.

Farm-level soybean prices should average $10.25 in 2025-26, up from $9.95 in 2024-25, providing some relief to American producers facing falling stocks.

The agricultural export landscape paints a picture of abundance tempered by regional constraints and logistical challenges. Producers must watch these evolving patterns carefully as they plan for the seasons ahead. Weather conditions, as always, could yet throw a monkey wrench into these projections before harvest time arrives.